Colliers International said that provision and integration of social infrastructure within mixed-use development, such as, open spaces, supporting retail, F&B, healthcare, education, and other commercial activities, has tangible positive impact on real estate demand. The company added that the novel coronavrius (COVID-19) outbreak has further emphasised these needs.

Colliers International has conducted a comprehensive research in Cairo regarding which factors determine price premium. The results for a well-designed mixed-use project could range from a premium of 25% to 45%.

Colliers International’s Cairo Real Estate Overview said that Greater Cairo has witnessed rapid development across its real estate market with a greater focus on two areas: New Cairo/New Administrative Capital and 6th of October cities during the last few years.

Cairo developers have always been at the forefront of innovation, through large scale master plans. However, societal demands are changing requiring greater integration of work, leisure, health, and education.

Regardless of the additional supply coming into the market within the new cities, the market is still witnessing a strong performance, Colliers said.

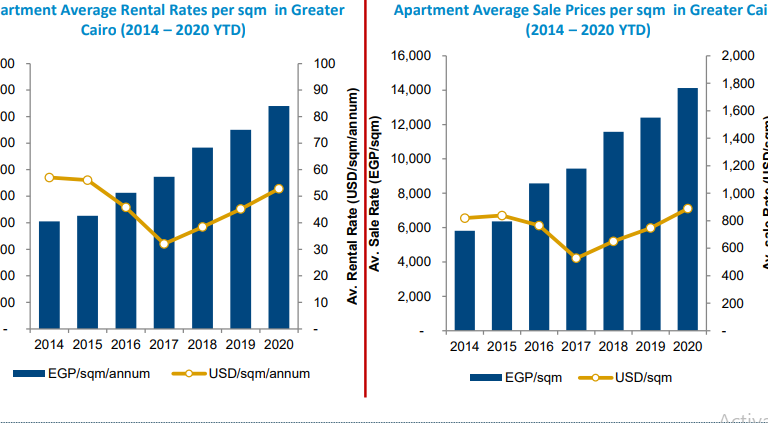

“The average sales rate across Greater Cairo increased by 14% to reach approximately EGP 14,100 per sqm ($888). Similar to the rental market, Zamalek is the most expensive area, given that it is an established high-end neighbourhood. New cities such as New Cairo and 6th of October are becoming more established districts offering a number of key community/lifestyle. New Cairo and 6th of October achieve an average sales rate of approximately EGP 11,400 ($718) and EGP 6,800 per sqm ($428), respectively,” the report read.

No comment yet, add your voice below!